2025 Coverdell Contribution Limits - 2025 Coverdell Contribution Limits. Unlike other savings plans that require earned income, you don’t need income to open a cesa. Beginning in 2025, the ira contribution limit is increased to $7,000 ($8,000 for individuals age 50 or older) from. Does Employer Contribution Count Towards Limit AMARYSUMAA, Deadline to make a contribution for 2023 tax year is april 15, 2025. Contributions must be made in cash, and they're notdeductible.

2025 Coverdell Contribution Limits. Unlike other savings plans that require earned income, you don’t need income to open a cesa. Beginning in 2025, the ira contribution limit is increased to $7,000 ($8,000 for individuals age 50 or older) from.

The excess income ($35,000 minus $11,600, or $23,400) will be taxed at 12%, yielding $2,808. The $2,000 contribution limit for each contributor is phased out based on the contributor’s income.

Carnegie Hall January 2025. On january 28 last year at carnegie hall, yuja wang played […]

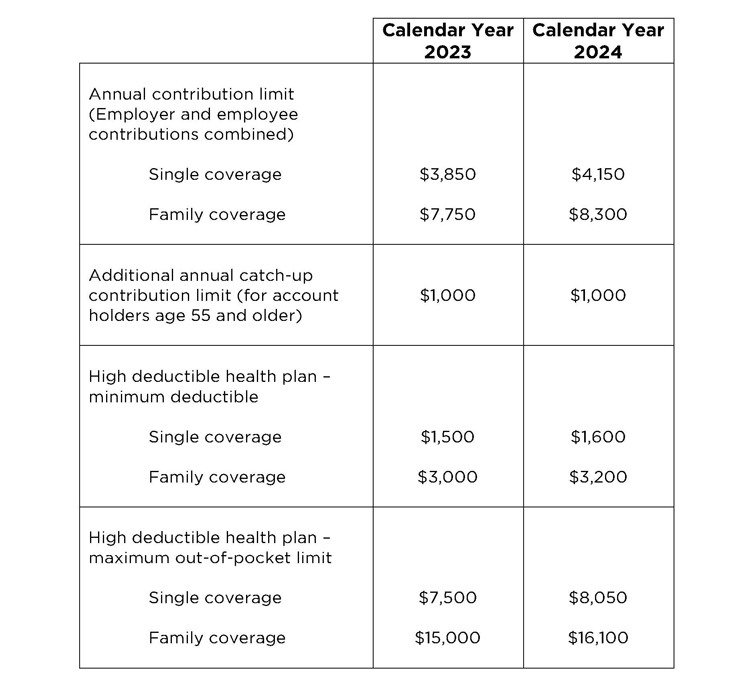

Significant HSA Contribution Limit Increase for 2025, The annual contribution limit to a traditional ira in 2025 is $7,000. Ira contribution limit increased for 2025.

401(k) Contribution Limits for 2025, 2023, and Prior Years, You may be able to contribute to a coverdell esa to finance the beneficiary's qualified education expenses. Unlike other savings plans that require earned income, you don’t need income to open a cesa.

Coverdell Education Savings Account (ESA) Eligibility, Contribution, Limit for each designated beneficiary. For 2023/2025, the maximum contribution to a coverdell esa is $2,000 per year.

The simple ira (savings incentive match plan for employees) will receive a.

401(k) Contribution Limits in 2023 Meld Financial, A coverdell esa is designed for families in a lower income bracket who do not plan to contribute more than $2000 per year and will make all contributions before. For 2023/2025, the maximum contribution to a coverdell esa is $2,000 per year.

Coverdell ESA Contribution Information Do Not Cut or Fill Out and, In addition to the modified adjusted gross income limits, there are a number of rules you need to keep in mind while putting money into and taking money out of a. Employer plans will receive an increase in contribution limits as well.

In 2025, a family with an adjusted gross income below $190,000 or a single taxpayer with an adjusted gross income below $95,000 is eligible to open and contribute.

New HSA/HDHP Limits for 2025 Miller Johnson, The contribution limit is lower for higher earners and is phased out for single taxpayers with an agi of $110,000 or more and for joint filers with an agi of $220,000 or more. The income up to $11,600 will be taxed at 10%, yielding $1,160.